By: Joshua Finley

With over two decades of experience in business valuation, Jeffrey Brewster has established himself as a leading figure in the industry. As the Founder and CEO of BT Valuation Inc., Brewster has dedicated his career to helping businesses understand and leverage their true value. Since its inception in February 2023, his company has specialized in providing comprehensive valuation services tailored for financial reporting, tax strategy, investment decisions, and risk management.

Crafting Strategic Value

BT Valuation Inc. is not just about crunching numbers; it’s about understanding what truly matters for a business’s growth and sustainability. The firm combines advanced data analytics with deep market insights to deliver accurate, actionable valuations that empower strategic planning and growth. “We specialize in providing top-tier business valuation tailored to meet the unique needs of CPAs, CFOs, attorneys, and business owners,” Brewster explains. “We want to unlock your business’s true potential.”

Common Mistakes in Valuation

In his extensive career, Brewster has identified three critical mistakes that businesses often make when it comes to valuation. Understanding and avoiding these mistakes can be the difference between success and failure.

Misunderstanding Cash Flow

“One of the biggest mistakes is not understanding cash flow,” Brewster emphasizes. Many business owners are not intrinsically connected to their cash flow, which can lead to trouble. Properly managing cash flow is not just about tracking income and expenses but understanding the deeper implications of cash flow on the business’s overall health and valuation.

Brewster shares an illustrative example: “We had a client who thought their reseller business was their best performing division, but they didn’t realize the consulting side was actually providing a better growth. By better understanding their cash flow, they could make more informed decisions that enhanced their business’s attractiveness to potential investors.”

Overlooking Working Capital Needs

Another common mistake is not understanding the level of working capital necessary to run the business. “Cash flow and working capital are intricately connected,” Brewster explains. A misstep in managing working capital can have a cascading effect on the business’s overall cash flow requirements, leading to financial instability.

Brewster says, “It’s amazing how, if you think you’ve got your working capital down, yet something else pushes on your overall cash flow requirements, it impacts everything.”

Ignoring the Impact of Interest Rates

The third major mistake is underestimating the impact of interest rates on the business. “For so long, businesses operated as if the low interest environment would remain indefinitely, but when they didn’t it caused a significant negative impact on the business,” Brewster notes. The sudden increase in interest rates has had lasting effects on many businesses that were not prepared for such changes.

Brewster advises that understanding how interest rates affect overall valuation and cash flow is crucial for strategic planning. “If you’re not intrinsically connected to your cash flow and understanding the impact that working capital and capitalization from other funding sources have, you’re in for trouble,” he warns.

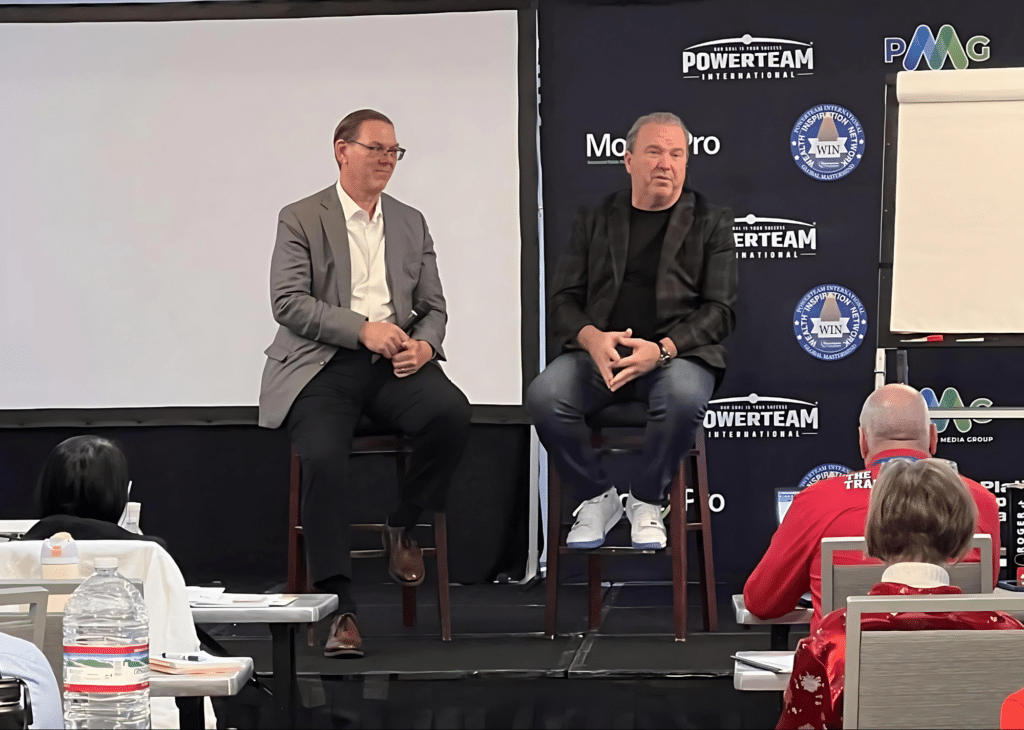

Photo Courtesy: BT Valuation Inc.

When to Think About Valuation

Many business owners only consider valuation when faced with a major event, like an unsolicited letter of intent or a potential transaction. However, Brewster advocates for a continuous focus on valuation. “The time to actually think about your valuation is not when a letter of intent lands on your desk,” he says. Instead, every decision a business owner makes should consider its impact on the company’s valuation.

Jeffrey Brewster’s insights underscore the importance of understanding and integrating valuation into every aspect of business strategy. At BT Valuation Inc., the focus is on empowering businesses to leverage their true value and make informed decisions that drive growth and sustainability.

To learn more about BT Valuation Inc., visit their website at BT-Valuation.com.

“This content is for informational purposes only and is not intended as financial advice, nor does it replace professional financial advice, investment advice, or any other type of advice. You should seek the advice of a qualified financial advisor or other professional before making any financial decisions.”

Published by: Holy Minoza