By: Zoe Williams

Venture capital fundraising is a cornerstone of innovation, propelling startups from nascent ideas into market-defining enterprises. This financial lifeline injects essential capital into emerging companies while equipping them with the mentorship and resources needed to navigate the complexities of scaling. At the heart of these fundraising activities is Regulation D, a set of rules governing private placements — the non-public offering of securities.

This regulatory framework, while offering a streamlined path to raising funds, delineates specific pathways such as the 506(b) and 506(c) offerings, each with distinct advantages and compliance requirements tailored to different fundraising strategies. Understanding these options is crucial for entrepreneurs aiming to align their capital-raising efforts with their business goals and investor base. Corporate and finance attorney Matt Melville decodes the complexities of 506(b) versus 506(c) offerings, guiding startups through the strategic considerations and legal landscapes that shape venture capital fundraising.

Understanding 506(b) Offerings

506(b) offerings, as delineated under Regulation D, represent a traditional route for venture capital fundraising, emphasizing relationships and trust. These offerings permit startups to raise an unlimited amount of capital from accredited investors—individuals or entities meeting certain financial criteria—without engaging in public solicitation or advertising.

Additionally, 506(b) allows for the inclusion of up to 35 non-accredited investors, provided they are sophisticated, meaning they have sufficient knowledge and experience in financial and business matters to evaluate the investment’s risks and merits.

“A hallmark of 506(b) is its requirement for a pre-existing relationship between the issuer and the investors, ensuring a foundation of mutual understanding and trust,” says Matt Melville. “This pathway offers the advantage of a more intimate and controlled fundraising environment, potentially reducing the risk of regulatory missteps.”

The prohibition against general solicitation limits the pool of potential investors, potentially slowing capital-raising efforts and restricting outreach to a broader investor base.

Exploring 506(c) Offerings

506(c) offerings under Regulation D mark a pivotal shift in venture capital fundraising, enabling startups to cast a wider net in their capital raising efforts. This provision distinctly allows for general solicitation and advertising, empowering companies to publicly market their investment opportunities, thus reaching a broader audience of potential investors.

Notes Matt Melville, “This openness comes with a stringent requirement, that all investors must be accredited, and issuers are tasked with taking reasonable steps to verify this status, often necessitating documentation of income or net worth.”

The primary benefit of a 506(c) offering lies in its ability to leverage modern marketing tools and social platforms to attract a diverse array of investors, potentially accelerating the fundraising process. Yet, this approach demands a higher level of diligence from issuers to comply with the verification requirements, introducing additional administrative burdens.

The exclusivity to accredited investors may limit access to a segment of interested parties who do not meet the stringent criteria despite their potential enthusiasm and capability to contribute to a startup’s growth.

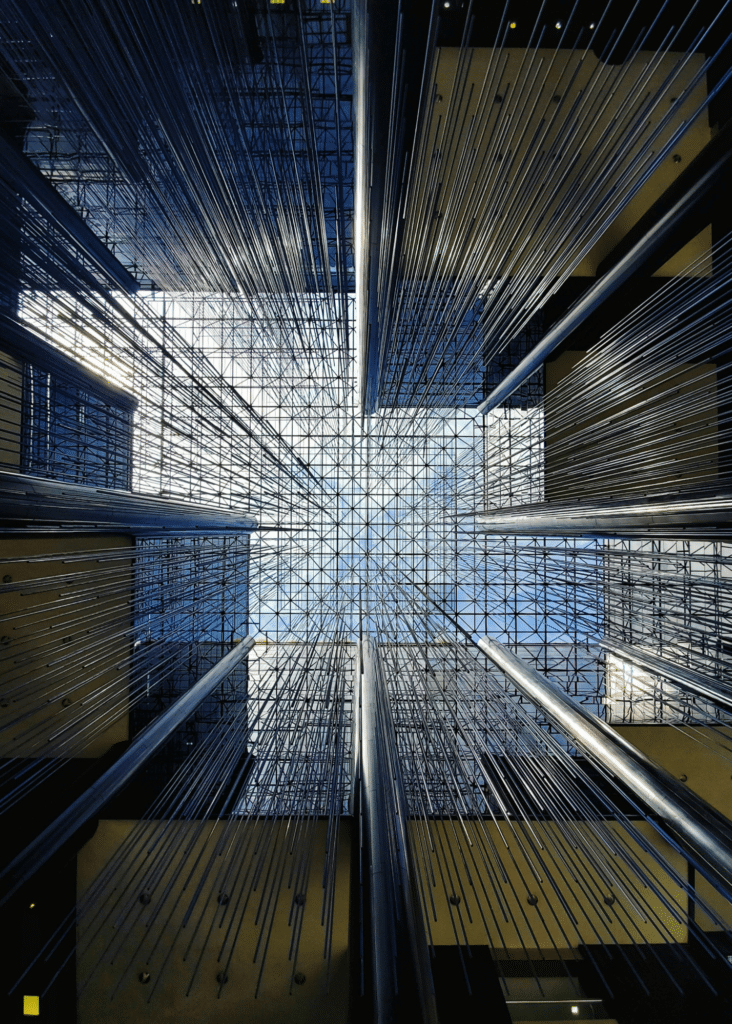

Photo: Unsplash.com

Strategic Considerations for Entrepreneurs

Entrepreneurs have crucial decisions before them when choosing between 506(b) and 506(c) offerings for their venture capital fundraising endeavors. This decision is influenced by several strategic considerations, pivotal among them being the nature and size of the target investor pool.

A 506(b) offering, with its allowance for a mix of accredited and sophisticated non-accredited investors, may be more suitable for startups with an established network of potential investors. In contrast, 506(c) offerings, requiring all investors to be accredited but allowing for general solicitation, can dramatically expand the investor pool, appealing to startups looking to maximize their reach.

“The role of general solicitation in a company’s fundraising strategy also weighs heavily. For those aiming to leverage extensive marketing and social media campaigns, 506(c) presents a clear advantage,” says Melville.

The increased regulatory compliance and administrative burdens associated with verifying accredited investor status under 506(c) offerings cannot be overlooked. Entrepreneurs must consider how their choice impacts the fundraising timeline and overall capital formation strategy, balancing the need for expedient capital raising with the regulatory rigor and relationship-building that different offering types entail.

Legal and Compliance Landscape

The legal and compliance landscape surrounding 506(b) and 506(c) offerings is a critical aspect of venture capital fundraising, shaped by the nuanced frameworks of Regulation D. Both offerings require issuers to navigate a complex array of legal stipulations to ensure compliance and safeguard their fundraising efforts from regulatory pitfalls.

For 506(b) offerings, compliance hinges on restricting solicitations to a pre-existing network of investors and meticulously vetting up to 35 non-accredited investors for sophistication. Conversely, 506(c) offerings mandate rigorous verification of every investor’s accredited status, demanding a higher level of due diligence and documentation.

Recent regulatory updates have further refined these landscapes, emphasizing the importance of transparency and investor protection in venture capital markets. These changes often aim to streamline the fundraising process while tightening investor qualification criteria, impacting how startups approach their capital raising strategies.

Entrepreneurs must stay abreast of these developments, understanding that adherence to the evolving legal framework is not just about regulatory compliance but about fostering trust and credibility in the investor community.

The Continued Significance of 506(b) versus 506(c) Offerings

The strategic interplay between 506(b) and 506(c) offerings under Regulation D is set to evolve, reflecting broader shifts in investment landscapes and technological advancements. The increasing digitization of capital formation processes, coupled with a more informed and diverse investor base, suggests that the distinctions between these two offering types may become more nuanced, with potential regulatory adjustments on the horizon to accommodate these changes.

Emerging technologies and the growing prominence of digital securities could redefine the mechanics of verifying accredited investor status and managing investor relations, possibly streamlining compliance burdens associated with 506(c) offerings. Meanwhile, the value of building trusted investor relationships inherent in 506(b) offerings could see new expressions through digital platforms, enhancing the reach and efficiency of traditional network-based fundraising.

As entrepreneurs and investors navigate this evolving terrain, the ability to adapt and leverage the respective advantages of 506(b) and 506(c) offerings will be paramount. Continued dialogue between regulators, startups, and the investment community is essential to ensure that the legal and compliance framework supports innovation while protecting investor interests, paving the way for a dynamic and inclusive venture capital ecosystem.

Published By: Aize Perez